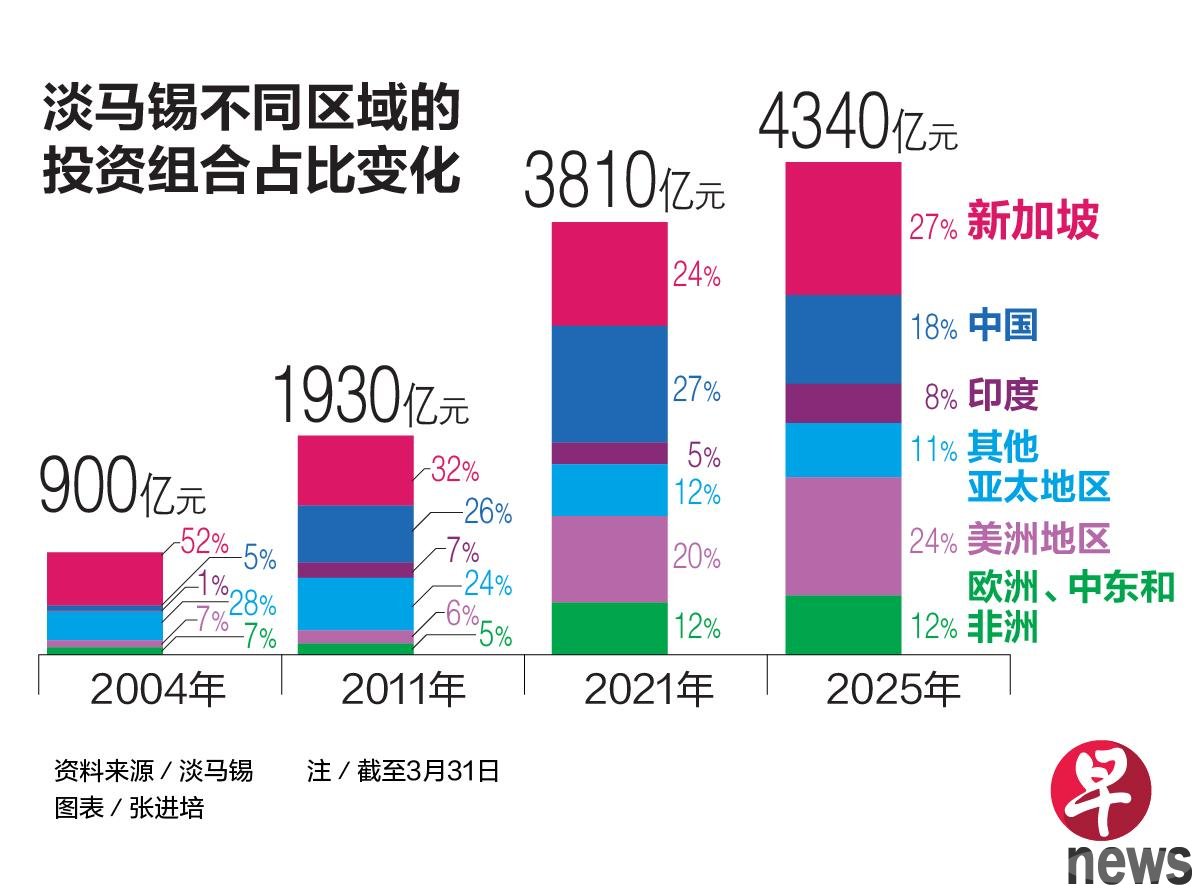

It is worth noting that Temasek's American investment share exceeded China's 20% in fiscal 2024, and expanded to 24% in fiscal 2025, making it the largest investment destination outside Singapore. Europe, the Middle East and Africa are the third largest overseas investment destination, accounting for 12%.

The total return on shareholders in one year was 11.8%, significantly higher than 1.6% in the previous fiscal year and the highest growth since 2021.Temasek's asset portfolio is dominated by Singaporean companies, including DBS Group, Singtel, Singapore Airlines, Singtel Engineering, and Singapore International Port Group, which account for 41% of the overall portfolio, with the rest being global direct investment (36%), as well as partner models, funds and asset management companies (23%).

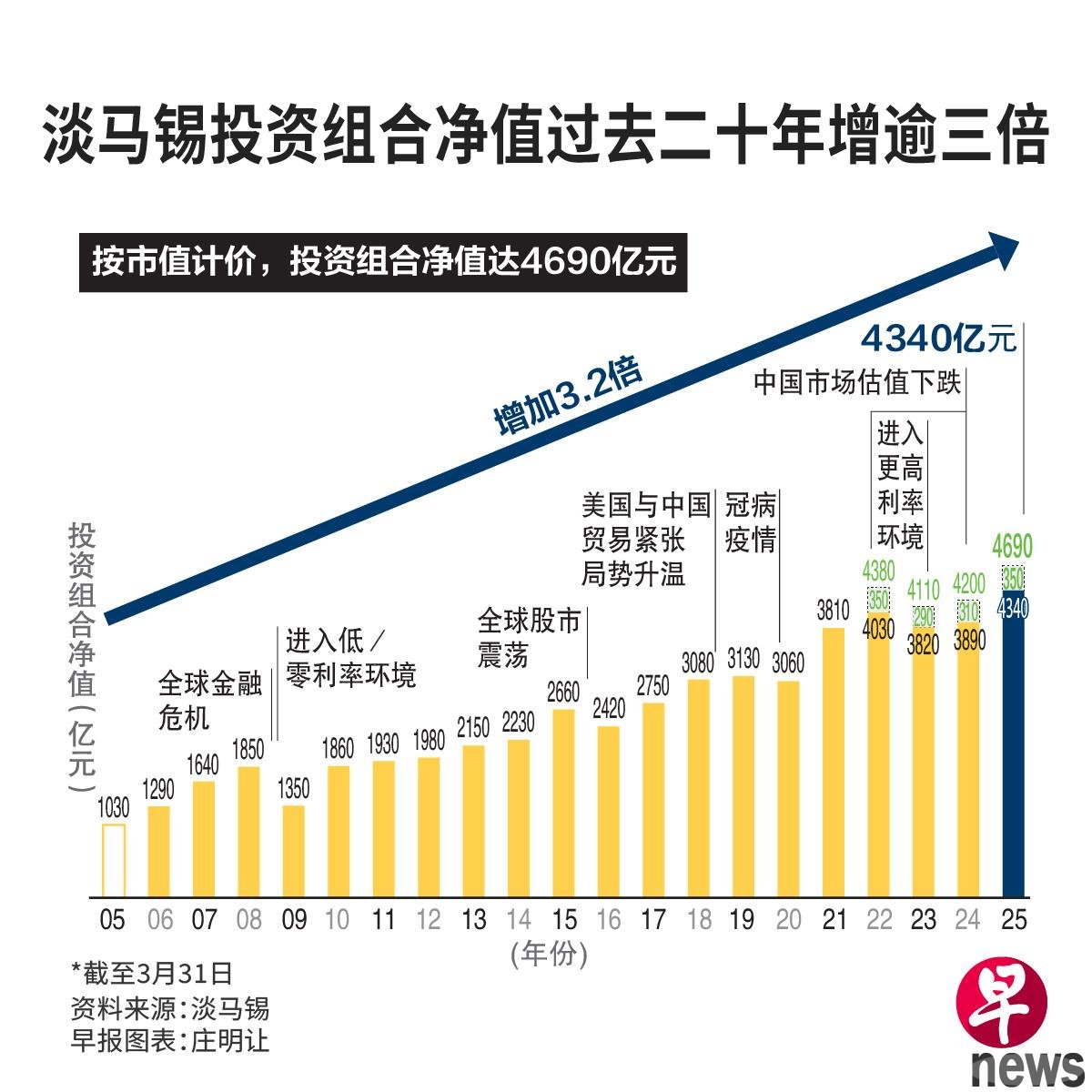

Temasek released its annual report for the 2025 fiscal year ended at the end of March this year on Wednesday (July 9). The total 20-year rolling shareholder return rate remained stable, as 7% as in the previous fiscal year. The total 10-year shareholder return has been reduced from 6% to 5%, excluding the market's performance in March 2015 and has made the return strong.

The strong performance of investments in Singapore-listed portfolio companies, as well as China, the United States and India, drove Temasek's portfolio net value to an all-time high in fiscal 2025, with a sharp increase of 45 billion yuan to 434 billion yuan this year.

Looking ahead, the uncertainty brought by the geopolitical situation is the biggest risk Temasek faces, but it will not slow down the pace of investment, but will steadily look for investment opportunities in the crisis.

Lin Mingpei, co-president of Temasek Corporate Strategy, said that China is developing towards a mature economy and will no longer maintain rapid growth in the past. China remains important, and if we adjust our expectations and regard it as a mature economy with long-term growth, we can find the right investment opportunities. She said Temasek will continue to deploy capital in China.

Regarding the changes in China's economic development model, Xie Songhui said: "This is not the first time we have adjusted our strategy to deal with the actual situation and future opportunities."

If calculated by market value (mark-to-market), that is, the market value of non-listed assets is taken into account, the net value of Temasek's investment portfolio is 469 billion yuan, 49 billion yuan more than the previous fiscal year. Among them, non-listed assets have brought an increase in value of 35 billion yuan. Over the past 20 years, despite repeated market turmoil, the net portfolio value has increased by more than triple.

Temasek Deputy CEO Xie Songhui told Lianhe Zaobao that although the proportion has decreased, in fact, the absolute amount of Temasek's investment portfolio in China is about 4 billion yuan more than the previous fiscal year.

Annual report shows that Temasek's share of investment portfolio in China further decreased in fiscal year 2025, from 19% in fiscal year 2024 to 18%, nine percentage points less than 27% in fiscal year 2021. Temasek pointed out that China's economy has shown signs of recovery, but it may take several years to recover.

Chinese investment falls, US investment rises

Chinese investment falls, US investment rises